Table of Contents

Navigating the Indian investment landscape can be daunting, especially with the plethora of options available. Mutual funds have long been the go-to, but Exchange-Traded Funds (ETFs) are rapidly gaining traction. So, if you’re wondering “Is it good to invest in ETF in India?”, this comprehensive guide is for you.

This article aims to provide a comprehensive guide on whether it’s a wise decision for you to invest in ETFs in the Indian market. We will delve into the basics of ETFs, differentiate them from Mutual Funds, discuss their pros and cons, evaluate their suitability for Indian investors, and explore the process of Systematic Investment Plan (SIP) in ETFs.

What are ETFs?

You can think of an ETF (Exchange-Traded Funds) as a basket of various securities like stocks, bonds, or commodities, traded on stock exchanges like Sensex or Nifty. Unlike mutual funds where the fund manager actively decides which assets to buy and sell, ETFs passively track an underlying index or benchmark. ETFs represent a unique investment vehicle that combines the features of stocks and mutual funds. ETF is very popular in USA, but is it good to invest in ETF in India? First let’s understand how ETFs differ from Mutual Funds.

How ETFs Differ from Mutual Funds?

One key distinction between ETFs and Mutual Funds lies in their trading mechanism. While you can buy and sell mutual funds at the end of the trading day at the Net Asset Value (NAV), ETFs are traded on the stock exchange like individual stocks. This feature provides investors with the ability to execute limit orders, stop orders, and short selling, adding a layer of flexibility not commonly found in traditional mutual funds. In mutual funds you usually get two different options IDCW and Growth. For more information in this visit the link.

What is the difference between IDCW and Growth mutual Fund?

Another point you need to note is that when you are selling an ETF, if there aren’t enough buyers you can not sell all the ETFs at once. In mutual fund there is no such problem because mutual funds are managed by asset management companies, and mutual funds are brought and sold directly from there. No need for buyer.

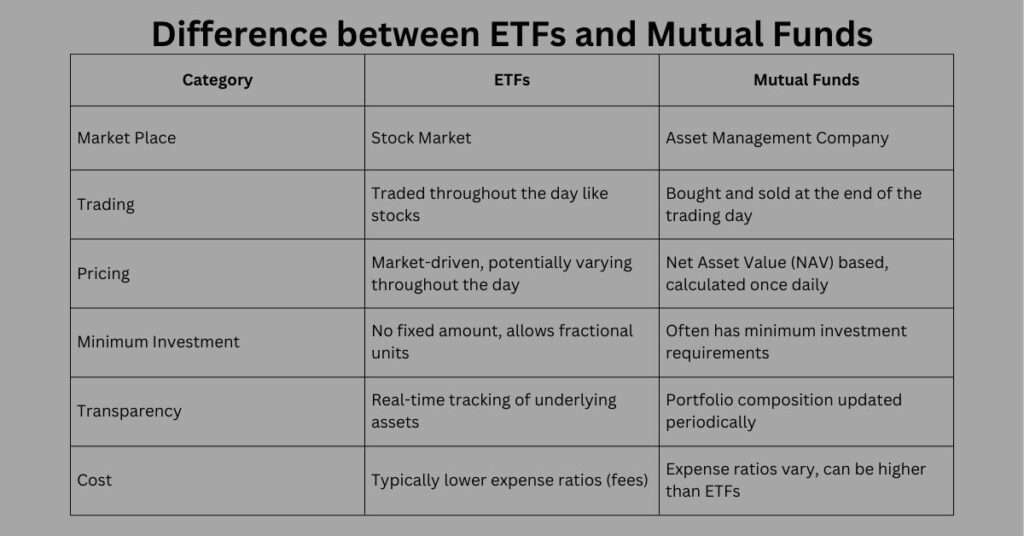

Following chart describe how ETFs differ from mutual Funds:

| Category | ETFs | Mutual Funds |

|---|---|---|

| Market Place | ETFs are bought and sold in Stock Market | Bought from Asset Management Company |

| Trading | Traded throughout the day like stocks | Bought and sold at the end of the trading day |

| Pricing | Market-driven, potentially varying throughout the day | Net Asset Value (NAV) based, calculated once daily |

| Minimum Investment | ETFs allows fractional units, so you can buy as mush as you want. | Often has minimum lump sum investment and minimum sip requirements. |

| Transparency | ETFs have Real-time tracking of underlying assets | Mutual fund Portfolio compositions are updated periodically |

| Cost | Typically lower expense ratios (fees) | Expense ratios vary, can be higher than ETFs |

Now that you know how ETFs differ from mutual funds, lets look at pros and cons of ETFs.

Pros and Cons of ETFs: Weighing the Advantages and Challenges

Pros:

- Diversification: Instant exposure to a basket of assets, minimizing risk through market fluctuations.

- Transparency: Real-time visibility into holdings and performance.

- Cost-effectiveness: Lower expense ratios compared to many mutual funds.

- Flexibility: Trade throughout the day for greater control and potential price advantage.

Cons:

- Market volatility: As ETFs are traded in market, prices fluctuate throughout the day. This makes it risker in short term investment.

- Limited choice of actively managed ETFs: Usually most ETFs track indices, offering less flexibility for strategic investing.

- Brokerage charges: Buying and selling may incur additional trading fees.

- Liquidity risk: If you don’t have enough buyers when you sell ETFs, you can not sell all your ETFs at once.

Different types of ETF

It’s important to understand the different categories of ETFs available to choose the one that aligns best with your investment goals and risk appetite. Here are the different types of ETF available.

1. Equity ETFs:

- Index ETFs: These passively track popular market indices like Nifty 50, Nifty Midcap 50, or sectoral indices like Nifty Energy or Nifty IT. They’re perfect for replicating overall market performance with low cost and diversification.

- Thematic ETFs: Focus on specific themes like infrastructure, clean energy, or specific industries like banking or pharma. They offer targeted exposure to niche sectors for niche interests.

2. Debt ETFs:

- Bond ETFs: Track bond indices like CRISIL Sovereign Bond Index or CRISIL Corporate Bond Index, providing exposure to fixed income instruments with varying maturities and risk profiles.

- Gilt ETFs: Invest in government bonds for stable returns and low volatility, ideal for risk-averse investors seeking capital preservation.

3. Commodity ETFs:

- Gold ETFs: A popular way to hold gold electronically, offering price transparency and liquidity through the stock exchange. They provide a hedge against inflation and market volatility.

- Other Commodity ETFs: Track the performance of specific commodities like silver, oil, or copper, offering exposure to global commodity markets for experienced investors.

4. Currency ETFs:

- Currency ETFs: Track the performance of a foreign currency against the rupee, allowing investors to hedge against currency fluctuations or speculate on currency movements.

5. Global Index ETFs:

- Invest in international markets: Gain exposure to foreign indices like S&P 500 or NASDAQ 100 without the hassle of directly investing overseas.

Bonus Categories:

- Leveraged ETFs: Amplify the underlying index movements, offering potential for higher returns but also magnified losses, suitable for experienced investors with high risk tolerance.

- Short ETFs: Take a bearish position on an index or sector, betting on its price decline. These are complex instruments and should be used with utmost caution.

Remember, each category has its own nuances and risk profile. Research well, understand the underlying index, and match it to your investment goals and risk tolerance before taking the plunge. Don’t hesitate to seek professional advice if you’re unsure about which ETF is right for you.

Is it good to invest in ETF in India?

The Indian market has seen a growing interest in ETFs due to their inherent advantages. The diverse range of ETFs available in India covers equity, debt, gold, and international assets. For investors seeking a passive investment approach, ETFs offer an efficient way to gain exposure to various asset classes with relatively lower costs.

The Indian ETF market is rapidly evolving, offering several benefits for investors:

- Access to diverse segments: Invest in specific sectors like infrastructure, technology, or gold ETFs.

- Cost-effective entry point: Lower expense ratios compared to many actively managed mutual funds.

- Regulatory oversight: SEBI regulations ensure transparency and investor protection.

- Growing popularity: Increased market participation and product availability.

Now you know if is it good to invest in ETF in India. Let’s look at SIP in ETF.

SIP in ETFs

If you want approach to investing in a disciplined way, you should start SIP. You can invest a fixed amount into your chosen ETF at regular intervals, leveraging rupee-cost averaging to mitigate market volatility. Most platforms now offer ETF SIPs, making it easier than ever to build wealth gradually. Lets look at how to do sip in ETF.

How to do SIP in ETF?

Setting up a Systematic Investment Plan (SIP) in ETFs is a straightforward process in India. Investors can follow these steps:

- Demat and Trading Account: Open a Demat and trading account with a registered stockbroker.

- Choose the ETF: Select the ETF that aligns with your investment goals and risk tolerance.

- Place SIP Orders: Set up a SIP by placing periodic purchase orders for the chosen ETF.

- Monitor and Adjust: Regularly monitor the performance of the ETF and adjust your SIP amount as needed.

Conclusion

While ETFs offer compelling advantages in the Indian market, they’re not a magic bullet. Carefully consider your investment goals, risk tolerance, and research thoroughly before embarking on your ETF journey. Now you can judge as per your investment style ‘is it good to invest in ETF in India’.

Here are some additional tips for investing in ETFs in India:

- Choose ETFs based on your investment objectives and risk appetite.

- Compare expense ratios and liquidity before investing.

- Start with a small amount and increase your investment time to time.

- Monitor your ETFs regularly and rebalance your portfolio as needed.

- Seek professional advice if you are unsure about investing in ETFs.

Remember, knowledge is your best investment. With careful research and a well-defined strategy, ETFs can be a powerful tool to build wealth and secure your financial future in the dynamic Indian market.

FAQ

- Can I sell an ETF anytime?

- Yes, you can generally sell an ETF any time during the stock market’s open hours, just like you can sell a stock. Keep in mind that, if there aren’t enough buyers in the stock market you will not be able to sell all of your ETF at once.

- Can I hold ETF for long time?

- You can hold ETF as long as you can just like a stock. Long term investing in ETFs is a great strategy to generate wealth.

- What is the lock in period in ETF?

- One of the advantages of ETF is that there is no locking period. You can sell anytime you want.

- Which is riskier ETF or mutual fund?

- Neither of them are risker than the other. Only thing to keep in mind that ETFs can be sell during the stock market opening hours but the mutual funds can be sold after the trading hours. But if there are not enough buyers you can not sell all of your ETFs at once, whereas you don’t need to worry about buyers in mutual fund.

- Do ETF pay dividends?

- Yes, if the underlying stocks of that ETF pay dividend, ETF will pay dividend.