Table of Contents

Digital gold has gained significant popularity as an investment option in recent years. With the ease of online transactions many people in India are considering digital gold as an alternative to traditional gold investments. However, it is important to know, is it profitable to buy digital gold. In this article, we will explore the concept of digital gold, its pros and cons, and try to answer why it may not be a favorable investment option in the Indian context.

Understanding the Concept of Digital Gold

Digital gold refers to a digital representation of physical gold that can be bought, sold, and held electronically. It is typically offered by online platforms or fintech companies that allow investors to purchase fractional units of gold. The digital gold is usually backed by physical gold held in vaults, and investors have the option to convert their digital holdings into physical gold if desired. This virtual form of gold ownership offers convenience and accessibility to investors, eliminating the need for storage and security concerns associated with physical gold.

Digital Gold Investment in India

In recent years, several digital gold investment platforms have emerged in India, capitalizing on the increasing demand for alternative investment avenues. These platforms allow investors to buy and sell digital gold using various payment methods, including online banking and digital wallets. The ease of accessibility and convenience offered by these platforms has attracted many investors, especially those who are tech-savvy and prefer online transactions.

From an investment perspective, digital gold provides potential returns based on the fluctuating market price of gold. However, it is important to note that the price of digital gold is not always aligned with the prevailing market price of physical gold. Factors such as demand-supply dynamics and platform-specific pricing mechanisms can lead to deviations in the digital gold price from the actual gold market price.

Challenges and Limitations of Investing in Digital Gold in India

Investing in digital gold in India is not without its challenges and limitations.

Lack of Regulations

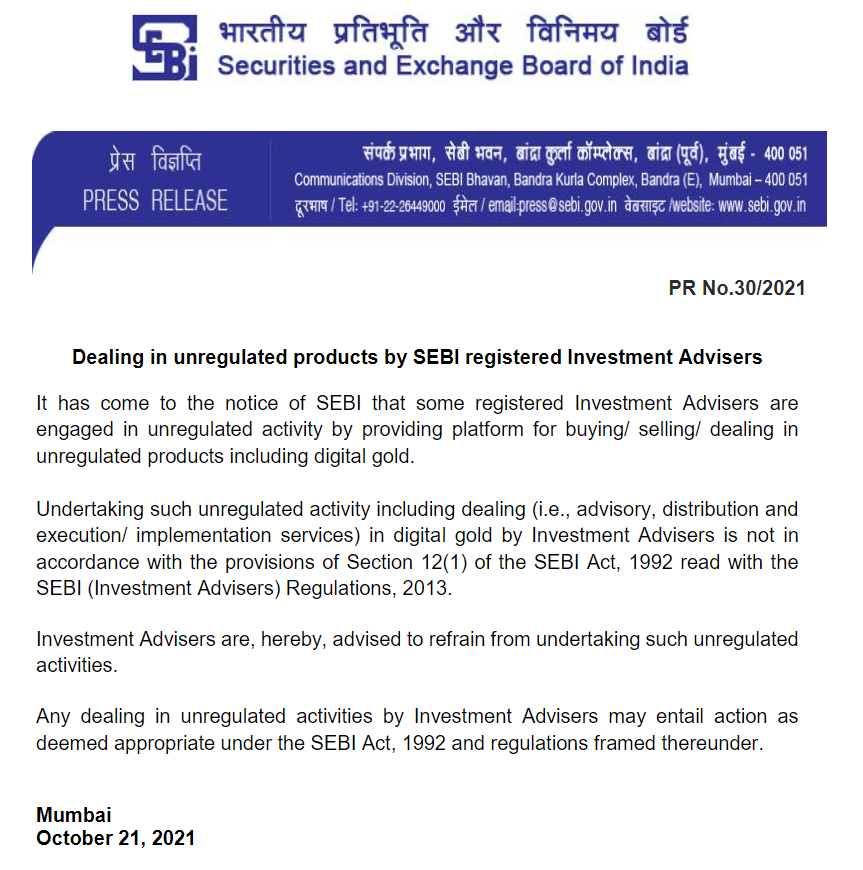

One of the major concerns is the lack of regulations in digital gold. Neither RBI nor SEBI regulates digital gold. This is one of the main reason why digital gold is not a good option. Read this article from SEBI to know more.

Lack of Transparency

Lack of Transparency and verifiability of digital gold holdings is another limitation. Unlike physical gold, where investors can physically possess and store their investment, digital gold relies on the trustworthiness of the platform or issuer. The absence of a robust audit mechanism and standardized industry practices makes it difficult for investors to ascertain the true value and ownership of their digital gold holdings.

Transaction cost

Transaction costs associated with digital gold transactions are also high. Buying and selling digital gold often involves fees and charges, including premiums and transaction fees. These costs can minimize the potential returns and make digital gold not a good option in India.

Security concerns

Security is also a significant concern when it comes to digital gold investments. While platforms may claim to have stringent security measures in place, there is always a risk of hacking or unauthorized access to investors’ digital wallets. This risk exposes investors to the potential loss of their digital gold holdings, making it imperative to choose reputable and secure platforms for digital gold transactions.

Moreover, investing in digital gold can have tax implications. The tax treatment of digital gold may vary based on factors such as the holding period, conversion to physical gold, and applicable tax laws. Investors should consult with tax professionals to understand the tax implications and obligations associated with digital gold investments.

Comparison with Traditional Gold Investments

When evaluating the suitability of digital gold as an investment option, it is important to compare it with traditional gold investments. Physical gold, such as gold jewelry or bullion, has a long-standing cultural significance in India and is often considered a reliable store of value. Unlike digital gold, physical gold offers the emotional satisfaction of ownership and can be passed down through generations as a inheritance.

From a liquidity standpoint, physical gold can be easily sold or pledged for financial needs. While some digital gold platforms provide options to convert digital gold into physical gold, the process may involve additional costs and logistical challenges. Physical gold also offers the flexibility of choosing different forms and designs, catering to individual preferences.

Furthermore, traditional gold investments, such as gold ETFs (Exchange-Traded Funds) and mutual funds, provide a regulated and transparent framework for investing in gold. These investment options allow investors to participate in the gold market without the need for physical possession. Gold ETFs and mutual funds are managed by professional fund managers, providing diversification and expert oversight.

Factors to Consider Before Investing in Digital Gold

Before investing in digital gold, it is essential to consider various factors to make an informed decision. Firstly, understanding one’s risk tolerance and investment goals is crucial. Digital gold investments, like any other investment, come with risks, and investors should be prepared for potential price fluctuations and market volatility.

Market volatility is an inherent characteristic of gold, and the price of gold can fluctuate significantly over short periods. Investors should assess their risk appetite and evaluate whether they can withstand potential losses or price corrections.

Diversification is another important aspect to consider. Investing solely in digital gold may expose investors to concentration risk. It is advisable to diversify one’s investment portfolio across different asset classes, such as equities, bonds, and real estate, to mitigate risk and enhance returns.

Thorough research and due diligence are essential before choosing a digital gold platform or issuer. Investors should consider the reputation, track record, and security measures of the platform. Reading reviews, seeking recommendations, and understanding the terms and conditions of the investment platform are vital steps in the due diligence process.

Alternatives to Digital Gold Investment

For individuals who are skeptical about digital gold or prefer alternatives, several other investment options are available in the gold market. One such option is investing in gold ETFs or gold mutual funds. These investment vehicles allow investors to indirectly participate in the gold market through shares or units of the fund, which are backed by physical gold holdings. Gold ETFs and mutual funds offer the benefits of diversification, professional management, and transparency.

Another alternative is investing in gold savings schemes offered by banks and jewelers. These schemes allow investors to accumulate gold gradually by making regular contributions. At the end of the scheme tenure, investors can either receive gold equivalent to their contributions or use the accumulated value to purchase gold jewelry or other gold products.

Sovereign gold bonds issued by the government are also a viable option for investors seeking exposure to gold. These bonds provide a fixed interest rate along with the potential appreciation in the gold price. Sovereign gold bonds can be held in dematerialized form, eliminating storage and security concerns associated with physical gold.

Conclusion: Is it profitable to buy digital gold

While digital gold has gained popularity as an investment option in India, it is important to evaluate its suitability and viability. The lack of transparency, high transaction costs, security risks, and regulatory concerns make digital gold a less favorable investment avenue for many individuals. Traditional gold investments, such as physical gold, gold ETFs, and gold savings schemes, offer alternative options with proven track records and established frameworks.

Before making a choice, investors should carefully assess their investment objectives, risk tolerance, and market dynamics. Thorough research, due diligence, and seeking professional advice are crucial steps to ensure informed investment choices. While digital gold may have its merits, it is important to weigh the advantages and disadvantages in the Indian context and align investment decisions with personal preferences and financial objectives.

FAQs

1. Is it worth buying digital gold in India?

The worthiness of buying digital gold in India depends on individual preferences, risk appetite, and investment goals. While digital gold offers convenience and accessibility, it also comes with certain risks and limitations. Investors should carefully evaluate the pros and cons, considering factors such as transparency, transaction costs, security, and regulatory concerns, before making a decision.

2. What are the advantages of investing in digital gold?

Investing in digital gold offers advantages such as ease of trading, divisibility, and the elimination of storage and security concerns associated with physical gold. It provides potential returns based on the fluctuating market price of gold, allowing investors to participate in the gold market without the need for physical possession.

3. How can I sell digital gold?

Selling digital gold typically involves accessing the platform or issuer through which the digital gold was purchased. The platform may provide options to sell digital gold and convert it into cash or other forms of investment. Investors should follow the instructions provided by the platform or seek assistance from customer support.

4. Are there any tax benefits for digital gold investments?

Tax benefits for digital gold investments may vary based on factors such as the holding period, conversion to physical gold, and applicable tax laws. Investors should consult with tax professionals to understand the specific tax implications and obligations associated with their digital gold investments.

5. What should I consider before investing in digital gold?

Before investing in digital gold, it is important to consider factors such as risk tolerance, investment goals, market volatility, diversification, and research. Thoroughly evaluate the transparency, security measures, transaction costs, and regulatory aspects of the platform or issuer. Conducting due diligence and seeking professional advice can help make an informed investment decision.